Feeling like you need some extra cash? Looking for a better option than dealing with strict financing options that limit how you can use your money? A HELOC may be just the solution you need.

When utilized correctly a Home Equity Line of Credit (HELOC) will not only help improve your immediate cash-flow, it can be a great way to grow your wealth.

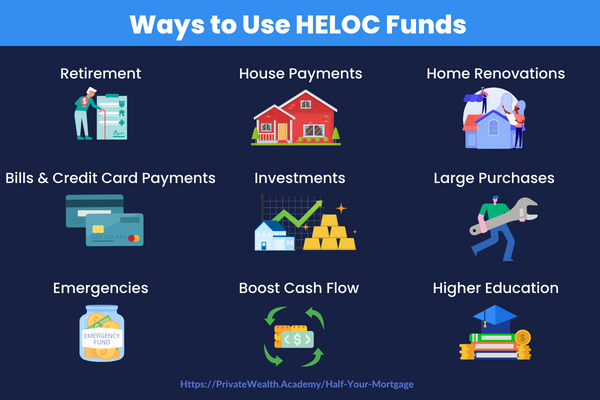

And best of all, there are virtually NO LIMITATIONS on how you can use your HELOC funds.

How a HELOC Works

A Home Equity Line of Credit is a flexible way to cover your expenses and often comes with lower interest rates than personal loans or credit cards. And unlike a mortgage or other loans that have specific purposes, a HELOC allows you to borrow against the money you've already put into your home to use for whatever you need. However, you should be careful not to misuse it or you might end up in financial trouble.

When used responsibly, a Home Equity Line of Credit can be a fantastic financial tool. Here are some smart ways you can make the most of your HELOC:

Ways to Use a HELOC

1. Home Improvements: If you want to repair or renovate your home, using your HELOC funds is a wise choice. It increases the value of your home and builds more equity.

2. Safe Investments (Real Estate, Precious Metals): If you have investments that aren't too risky, using your HELOC funds can be a good way to put your money to work. But be cautious if you're new to investing, as certain options like playing the stock market or buying real estate can be risky.

3. Major Necessary Expenses: If you have unexpected expenses like car repairs, a broken fridge, or a new addition to the family, a Home Equity Line of Credit can help you cover these without resorting to high-interest credit cards or personal loans.

4. Debt Consolidation: If you're thinking about combining your debts, a HELOC can be a great solution. Compare the interest rates to see if it's lower than what you're currently paying; if it is, you can pay off your debt more easily without involving a third-party company.

5. Education Costs: If you or a family member are paying for education expenses, a HELOC could be a good option, especially if you're considering a student loan. Make sure to compare interest rates to save money.

6. Medical Bills: High medical expenses or hospital bills can be overwhelming. Look into a HELOC as it might save you a significant amount compared to using a credit card.

7. Emergency Fund: If you don't have an emergency fund, a HELOC can provide you with immediate access to cash when you need it.

These are just some of the ways you can use a Home Equity Line of Credit. With a HELOC, you have the flexibility to use the funds however you need, when you need them.

We strongly recommend getting approved for a HELOC now, so you have funds readily available when unexpected emergencies or other needs arise.

The best part is, despite sky-high interest rates everywhere else, home equity lines of credit come with very low interest rates making them one of the most affordable funding options out there.

In the Half Your Mortgage program, we offer more smart investment ideas and teach you our proven HELOC Hyperdrive Strategy to enhance your cash flow and pay off your 30 year mortgage in 5-7 years. See how much money people like Nickolas saved by using this strategy in the Half Your Mortgage program.

Curious how much a HELOC can save YOU? Schedule a FREE Discovery Call with our HELOC specialists. During the call, we'll explore how a HELOC can effectively cut your mortgage in HALF, whether it's a new or existing loan. We'll use our unique software to analyze your numbers, showing you exactly how much you'll save in interest. And we'll determine the precise pay-off date when you'll be mortgage-free.