Are you interested in better understanding how the HELOC strategy works? Let's dive into that today.

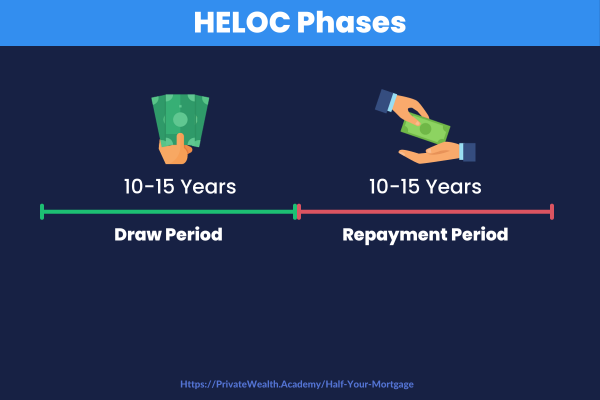

With a HELOC, similar to other types of finance you have a period of time where you can withdraw funds - this is called the 'draw period." Typically the draw period is 10-15 years. Once the draw period ends, the repayment period starts where you need to make payments on both the loan amount and the interest.

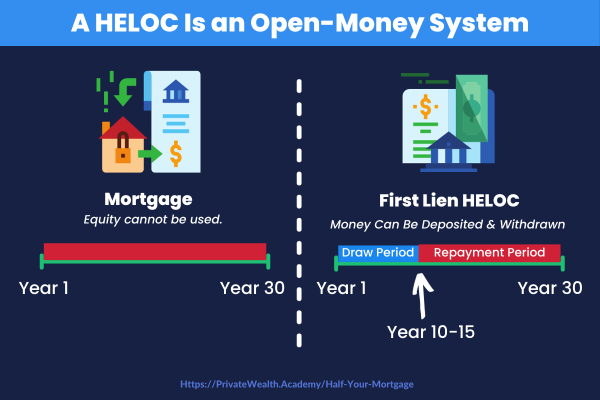

HELOCs Are An Open-Money System

Our recommended type of HELOC works like an "open money system." That means you can withdraw and deposit funds like a normal checking account.

We suggest putting all your income into the HELOC operating account and using it to pay your regular expenses. This makes it easier to manage your finances and reduces both the principal balance and interest at the same time. Talk about a WIN-WIN!

The HELOC Strategy Explained

Step 1 - Deposit your paychecks into the HELOC account

Step 2 - Use the funds for whatever you need

Step 3 - Pay down the balance from the HELOC account

As the HELOC balance goes down, your interest and monthly payments decrease too.

Here's the great part: with our repayment strategy, you can pay off your HELOC in 7 years or less, before the official repayment period starts allowing you to save the most interest possible.

What Happens When the HELOC Ends

When the repayment period ends, your lender might suggest keeping the line of credit open for future borrowing. Which may be a good idea so you don’t have to go to all the trouble of opening a brand new home equity line of credit.

If you run into cash-flow issues and have trouble making payments, don't worry. You have refinancing options which can allow you to start a new draw period.

Ready to cut your mortgage in HALF?

If you haven't do so already, start by watching our brand NEW (FREE) Half Your Mortgage workshop. It's only 60 minutes long and explains how this incredible process works.

Schedule a FREE Discovery Call with our HELOC specialists. During the call, we’ll explore how a HELOC can effectively cut your mortgage in HALF, whether it's a new or existing loan. We'll use our unique software to analyze your numbers, showing you exactly how much you'll save in interest. And we'll determine the precise pay-off date when you'll be mortgage-free!