Have you been hearing the phrase HELOC or home equity line of credit recently? Wondering what the benefits of this kind of financing can provide? That's what we'll be diving into in today's post.

Before Diving Into the Benefits of a Home Equity Line of Credit...

Do you know what the term 'mortgage' truly means?

Derived from old French and Latin, the word 'mortgage' literally means a "death pledge." Shocking, isn't it? Let's face it - a mortgage can feel like a death pledge since you gotta make those payments for 30+ years. Plus, a single missed payment can leave you stripped of all the equity you've diligently built in your home. Furthermore, many homeowners find themselves in the disheartening position of owing more than their homes are worth.

Fortunately, there's a life-changing solution for homeowners like you...

the Home Equity Line of Credit (HELOC).

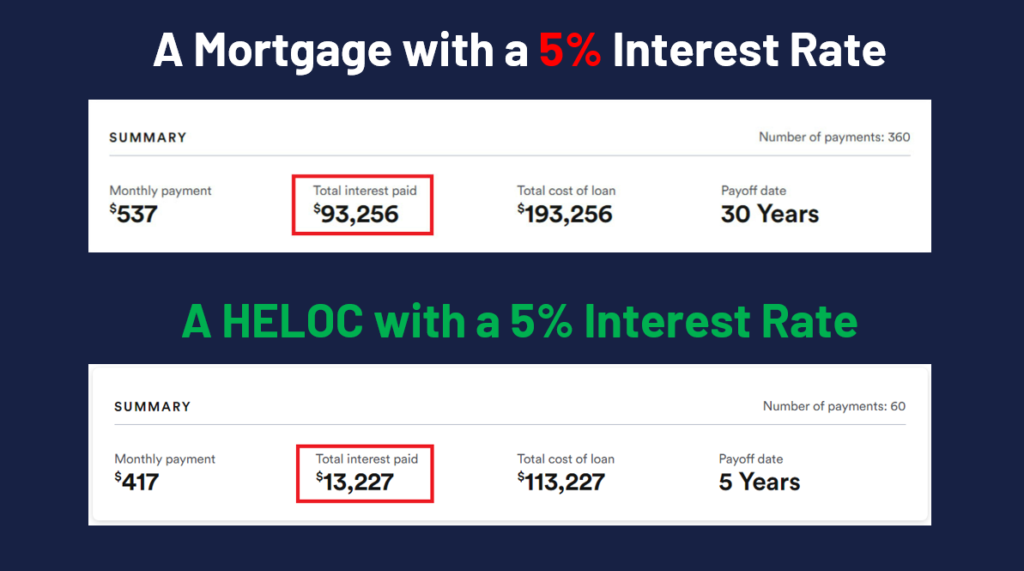

Imagine reducing the time it takes to pay off your home from 30 years to just 5-7 years. Sounds amazing, doesn't it? But what if there was even MORE a HELOC can do for you?

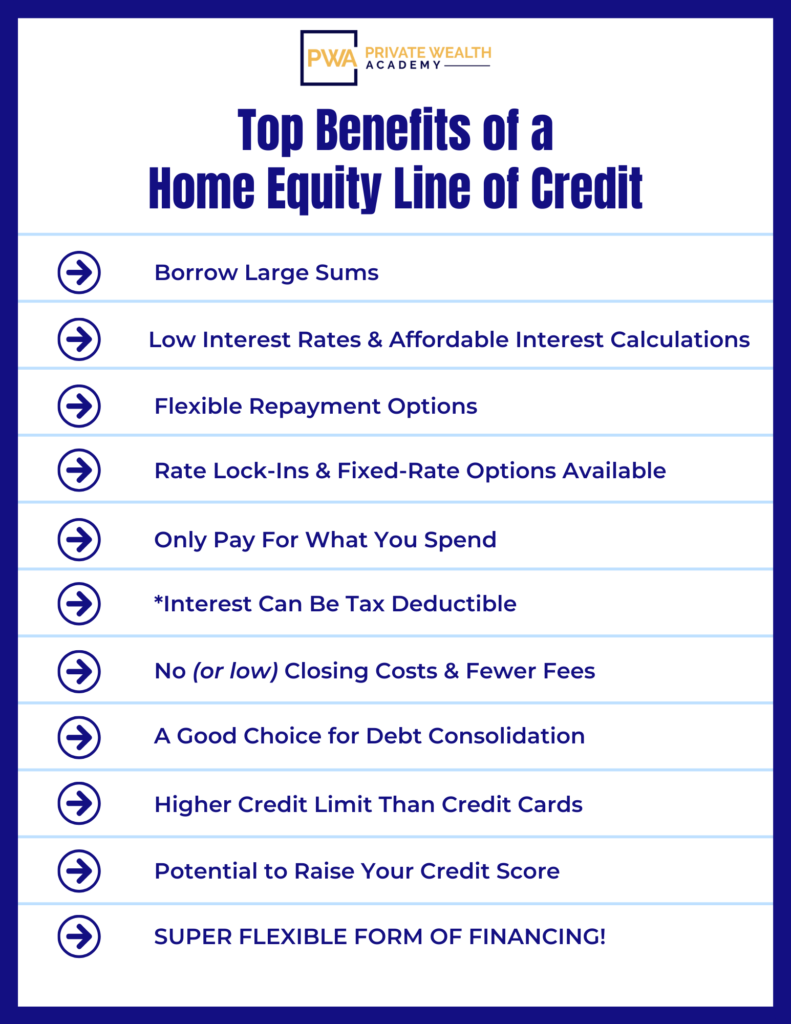

Benefits of a Home Equity Line of Credit

Years of research has led us to uncover numerous benefits of a HELOC. Today we’ll share the top 12 life-changing benefits with you:

1. Borrow Large Sums: With a HELOC, you can typically borrow up to 80-85% of your home’s value, minus outstanding mortgage payments. Some lenders even allow up to 95-100%.

2. Low Interest Rates: HELOCs often offer significantly lower interest rates compared to other forms of financing. Additionally, take advantage of very low introductory rates that can last from 6 to 12 months.

3. Flexible Repayment Options: HELOCs empower you with customizable repayment options. The duration of your HELOC varies based on the amount borrowed and the lender, commonly extending up to 30 years.

4. Fixed-Rate Options: Contrary to popular belief, HELOCs can come with fixed-rate options. Even variable rate HELOCs offer the flexibility to lock-in rates or convert a portion to a fixed rate.

5. Pay Only for What You Spend: Unlike traditional mortgages that require you to take out a lump sum, HELOCs allow you to withdraw funds as needed. You only pay interest on the amount borrowed, making it more affordable. Opt for the freedom of a smaller monthly payment if you end up utilizing less cash.

6. Interest Can Be Tax Deductible: According to the IRS, the interest on home equity lines of credit is tax-deductible if the borrowed funds are used to repair or improve your home. This deduction applies to loans secured by your primary or second home, meeting specific requirements.

7. Often There's No Closing Costs: HELOCs often come without the burden of hefty closing costs. In the rare cases when these costs apply, lenders typically cover them or offer coverage up to a certain amount. Compared to traditional mortgages, HELOC closing costs are generally far less.

8. No Fees for Cash Draws: Most HELOC lenders eliminate fees for utilizing your line of credit, ensuring easy accessibility to your funds.

9. Ideal for Debt Consolidation: Considering their lower interest rates and initial costs compared to credit cards or personal loans, HELOCs serve as an attractive option for consolidating debt or funding ongoing projects with higher expenses.

10. High Funding Limits: HELOCs offer borrowers a significant credit limit determined by factors such as home equity, credit score, and other considerations. Qualified borrowers with substantial equity may secure approval for amounts ranging up to $1,000,000 or even up to $2 million in high-cost states like California.

11. Potential to Raise Your Credit Score: Your payment history and credit portfolio diversity play crucial roles in determining your credit score. By including a HELOC in your credit mix and making on-time monthly payments, you can bolster your credit history and establish a reputation of sound financial management. Discover a little-known technique to instantly boost your credit score in a matter of days with a simple phone call.

12. Super Flexible Financing: One of the primary advantages of HELOC loans lies in the absence of usage restrictions. The versatility of HELOC funds allows you to employ them in any way you desire, catering to your specific needs and aspirations. Naturally, responsible borrowing is crucial, just as it is with any form of financing.

This list merely scratches the surface of the countless advantages a HELOC can offer. If you're a real estate investor, the benefits of a HELOC would be twice as long as this list!

Guess what else? A Home Equity Line of Credit (HELOC) is actually easier than qualifying for a mortgage.

A Home Equity Line of Credit Can Cut Your Mortgage in HALF!

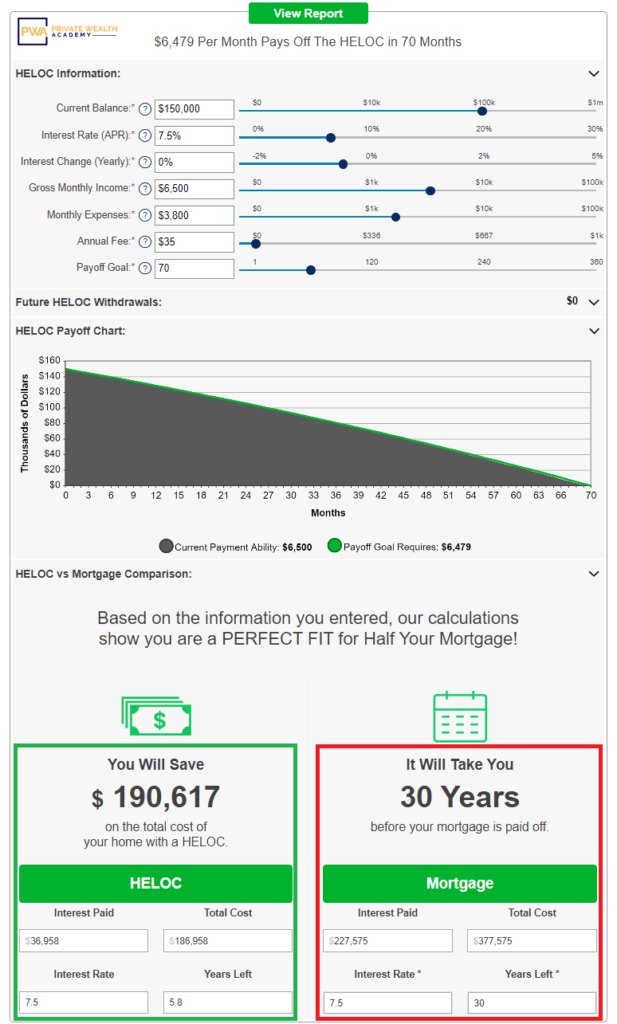

So if you’re tired of paying double interest on your mortgage - it's time to learn how to cut it in half! With the Half Your Mortgage program, designed to guide you through the entire process of securing a HELOC at the most affordable rates.

With our program, we will show you the right type of HELOC to pursue, provide you with the exact criteria to look for, help you prepare your finances, calculate potential interest savings, and grant you exclusive access to easy-to-use proprietary calculators.

To top it off, you'll receive a customized list of HELOC lenders specific to your state, along with a questionnaire to ensure you ask the right questions when approaching lenders.

Stop overpaying on your mortgage and start your journey to financial freedom with a HELOC today!

What's the Next Step?

We understand you probably have a lot of questions. If you haven't do so already, we recommend you watch our FREE Half Your Mortgage workshop. If you've already watched the workshop - the next step is to Book a FREE Discovery Call with Our Team to discuss how a HELOC can cut your mortgage in HALF, whether it's a new or existing. Using our state-of-the-art proprietary software, we'll run the numbers with you, calculate your interest savings, and determine your payoff date.