Have you ever wondered if mortgages are a scam? Or curious how our team at Private Wealth Academy discovered all the financial secrets we're sharing? Well, let us fill you in.

How We Discovered Mortgages Are A "Scam"

Our goal at Private Wealth Academy is to carry on the work of Carlton Weiss. Carlton was a private investigator who spent more than two decades delving into the financial affairs of some of America's wealthiest people. Thanks to his expertise, we had the chance to meet and learn from some incredibly wealthy individuals.

Now, Carlton was a very logical person, and he was particularly focused on unraveling the intricacies of private trusts. But there was something else that truly opened his eyes to what he called "failures by design" – it was how the rich and powerful handled mortgages.

Carlton had successfully investigated and exposed shady trusts, "sovereign citizens," and those trying to hide their wealth without a legitimate private trust. One night he was invited to a banquet, where everyone was on good terms. As luck would have it - Carlton had the pleasure of sitting next to a banker friend of a wealthy client of his, which would go on to change everything Carlton knew about the housing industry.

The Banker Admits Mortgages Are A Scam

As the evening went on and a few glasses of wine were consumed, the conversation turned to housing. Carlton asked the banker if it was a good time to get a mortgage. The banker's response was astonishing. He laughed and said mortgages are a scam, designed to benefit the banks by creating unlimited credit for them.

The banker explained that banks educate people so that they rush to refinance when interest rates drop, thinking they're getting a better deal. In reality, this extends the banks' profits even further.

Carlton was taken aback by this revelation. As the banker jotted down some notes, he shared a mind-boggling truth with Carlton.

"Hey, Carlton, you're a smart man. Have you ever read over the document called a Loan Estimate or Truth-in-Lending disclosure? If you read between the lines you'll understand you're essentially buying a house for yourself and one for the bank!"

Then he pointed out something shocking:

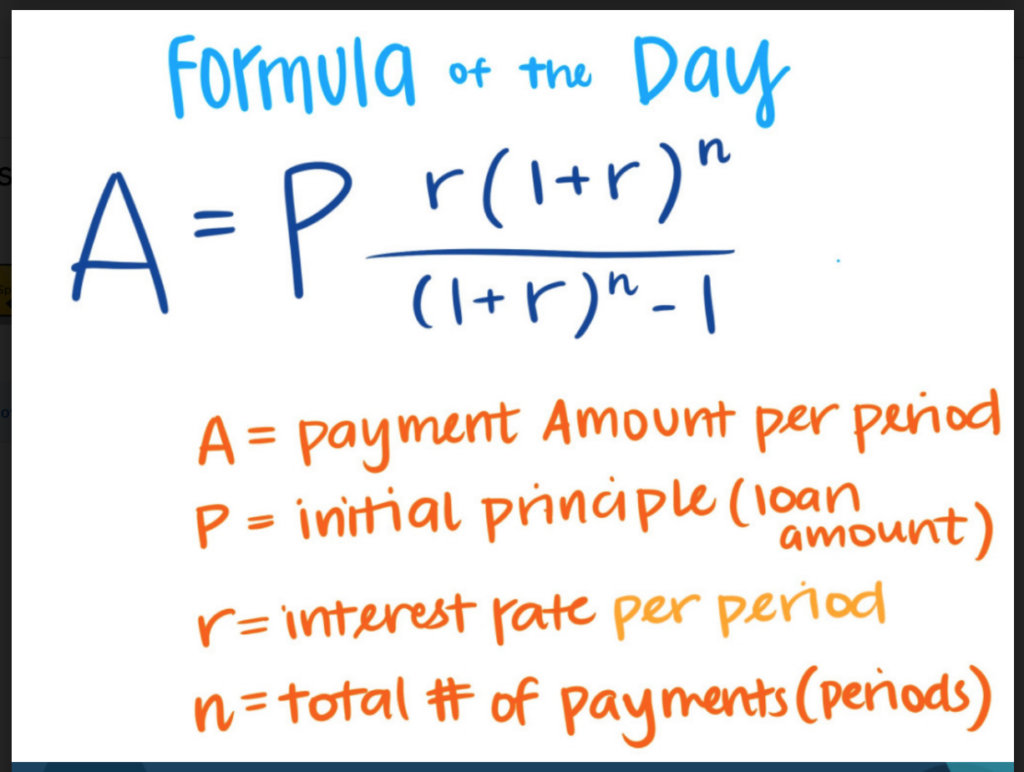

"Have you ever noticed that even after paying your mortgage for 5 years or more, it seems like you've barely made a dent in the actual amount you owe? Well, that's not a coincidence. Mortgages are designed that way on purpose. It's all about the math, and if you don't understand it, you can end up financially stuck for life."

He laughed manically and poured himself more wine.

Carlton, intrigued, asked, "So if all mortgages are a 'scam,' what's the alternative?" The banker laughed heartily and finally, with a serious tone, told Carlton that he wasn't about to reveal one of banking's biggest secrets.

How Carlton Uncovered the Truth

After that dinner, Carlton left feeling unsatisfied but incredibly curious.

The banker, intentionally or not, had unveiled a huge secret about mortgages that only a small group of people know about. Carlton, being the diligent private investigator he was, became determined to uncover the truth about mortgages and find the smarter alternative.

He started by talking to his friends in real estate, asking them all sorts of questions in search of the little-known alternative the banker had hinted at. Surprisingly, they had no clue; mortgages and cash purchases were all they knew about. Keep in mind, this was back in the early '70s when this alternative method wasn't widely known.

Carlton then tried calling the banks directly, but that didn't lead anywhere. He hit a dead end. So, he kept investigating, learning behind-the-scenes secrets of how wealthy individuals handled home purchases.

Feeling a bit down one night, Carlton decided to have a glass of wine with a friend who worked at a nearby credit union. He explained his situation and the mortgage alternative he was seeking. His friend mentioned something called a Home Equity Line of Credit (HELOC). This was the answer Carlton had been looking for!

A Home Equity Line of Credit As a Mortgage Alternative

A HELOC allows you to tap into your home's equity and use it like cash. It's a brilliant concept. Carlton got back to work, researching everything he could about HELOCs. With this newfound knowledge, he realized that HELOCs let you tap into your home equity and repay it like you would with a credit card, except with MUCH LOWER interest rates. And unlike a mortgage, you can turn your home equity into cash without violating any rules.

Carlton wanted to share this discovery with the public as soon as possible, but there were still many questions to be answered, like why people hadn't heard of this before and why lenders didn't promote it. He knew there was more to learn before he could tell the world.

So, he stepped back and delved even deeper into the real estate and lending communities, discovering what ultra-wealthy individuals were doing. He analyzed everything he found until one day, he had an epiphany...

He stumbled upon something that could completely change the game for homeowners by reducing the time it takes to pay off a 30-year mortgage down to 5-7 years and cut the cost of the mortgage in HALF! Don't worry; we'll share this game-changing discovery in tomorrow's post. In the meantime, if you haven't watched our FREE brand NEW Half Your Mortgage workshop, we encourage you to do so. It's available for you to watch right here.

Schedule a FREE Discovery Call with our HELOC specialists. During the call, we'll explore how a HELOC can effectively cut your mortgage in HALF, whether it's a new or existing loan. We'll use our unique software to analyze your numbers, showing you exactly how much you'll save in interest. And we'll determine the precise pay-off date when you'll be mortgage-free.